As the lines between the terms amateur, hobbyist and professional, blur and disappear faster

than one can say, “Do it yourself,” prudence demands a moment to take an objective look at the

reality of this modern mindset. Many endeavors neatly fall on the extremes of the feasibility

and sensibility spectrum. If the urge to build a raised garden in the backyard strikes, by all

means do your research, buy supplies and settle in for a long weekend of miniature triumphs and

defeats. You might just quit, or maybe you’ll construct a landscape worthy of next month’s

Architectural Digest. In all likelihood, the result will fall somewhere in between and the

mission’s final value will lie in the eye of the amateur gardener with no life altering

consequences.

On the other extreme, it would be inadvisable, moronic and possibly illegal (depending on

chosen anesthetics) for even a surgeon to attempt a repair of their own torn anterior cruciate

ligament. There is no amount of money saved, pride in accomplishment, or chance of success that

can outweigh the astronomical level of risk and probability of a knee-ruining, life-altering

misadventure.

The two aforementioned cases are oversimplified, extreme examples. Nearly all the other tasks

subject to the current DIY fetishism fall somewhere between these two poles. Garden construction

might be fun, but hanging a door by oneself as an amateur carpenter can quickly become a unique

way to ruin a Sunday, and while self-surgery is out of the question, saving time and money

through sober self-triage is often preferable to a trip to the ER. Plumbing, selecting health

insurance, even filing one’s own taxes—just about every facet of our lives now involves some

degree of choice when it comes to participation.

Not playing nicely among the mostly two-dimensional spectrum of appropriate day to day

undertakings is the decision on how your money is managed and who manages it. Not long ago, the

decision for most people was limited to choosing a person, or firm, to undertake this task for

them. Of course, that decision wasn’t always easy and even after this selection there were

typically a few brief, but important questions that aimed to steer the overall plan in

accordance with the client’s aims and risk tolerance. Other than the bank transactions and

requisite signatures, that was often it for client participation.

Over the past two decades, an explosion of discount brokerage services combined with widespread

internet accessibility has shifted the way financial institutions conduct business and have

opened the door for the non-professional to play a larger role in investing their own money.

Judging by some of the commercials that advertise trading on these platforms, one would be a

fool not to be actively trading their own money! A viewer watches the blissfully couple, with

confident auras and big smiles, casually walking through a complex sea of high-tech figures and

graphics, eventually ending up on a beach at sunset. There are some important if not obvious

caveats to remember before being taken in by this theatre: these are paid actors and not real

stories, the company’s main goal is to make money by having you use their platform, regardless

of your outcome, and no, trading your own money profitably is not that easy. Sure, you can start

trading today with no minimum balance and low-commission trades, but should you?

Just because you can do something doesn’t mean that you should

, and in all but the most egregious instances, the amount that you can save on brokerage and

management fees is probably one of the least important factors in choosing a financial roadmap.

At the end of the day, or in this case one’s career, the goal of investing is to have at least

enough funds to retire comfortably. Once that objective can be reasonably assured, then the next

aim would be to maximize the amount of one’s investments and perhaps spend some time on the

beach with the folks from the comically scripted commercial. In the real world, how does one get

there? We can look at three generalized routes: personal selection of financial instruments

(stocks, bonds, futures, etc.), diversified investment vehicles (index funds, ETFs, etc.), and

actively managed funds where managers attempt to beat the market by picking and choosing

investments and actively trading other financial products. In reality, there are many

subcategories to each of these methods and many investors will involve a varied mix of all

three.

With the increase of low brokerage, online trading platforms, there has been a corresponding

rise in criticism of actively traded funds, much of it centering around the annual fees deducted

for management. “Why pay a firm money to do things that you can do yourself?” seems to be the

underlying logic of the critique. Perhaps a better question is, “Would you be upset if you paid

someone a bit of money, if it made you more money than you would have on your own?” If your

answer to this question is yes, then I would advise you to stop reading. No matter how you

invest, or how much the investments succeed or fail, you are likely the type that will spend

their retirement on a beach,

only to ruminate about how much more you could have had

. This is exactly the emotional nerve that online brokers intend to pluck when touting their

low-rates. As an American, the ultimate insult is to have someone cheating you out of your hard

earned cash. The fact that they aren’t really cheating you out of anything, but providing you an

incredible service for a very fair price is something that used to be considered good business.

It still is.

For the sake of the exercise, let’s assume that these actively traded funds actually have been

taking advantage of their hapless customers. Luckily, the advent of index funds, ETFs (exchange

traded funds), and other passively managed funds have come to the rescue of the pedestrian

investor who is too smart to be ripped off by the old brick and mortar firms. These vehicles are

numerous and varied, and even a few can reflect bearish sentiment on the market through

ownership. However, most of them share two common traits, they are very diversified and almost

always bullish. They place investors in a position to capitalize on the growth of certain

industries, or the economy as a whole, all while saving money on management fees.

There is plenty of wisdom in this approach to investing. Even a reasonable manager fee-range of

55 to 85 basis points, when sacrificed and compounded annually, can result in significant

reductions in long-term profit. An e-mini (the most actively traded S&P 500 index contract)

purchased for $2,028.18 on January 1, 2015 was worth $3,278.20 on January 1, 2020. It’s hard to

argue with 10.1% year over year growth, and it’s better than most returns on actively traded

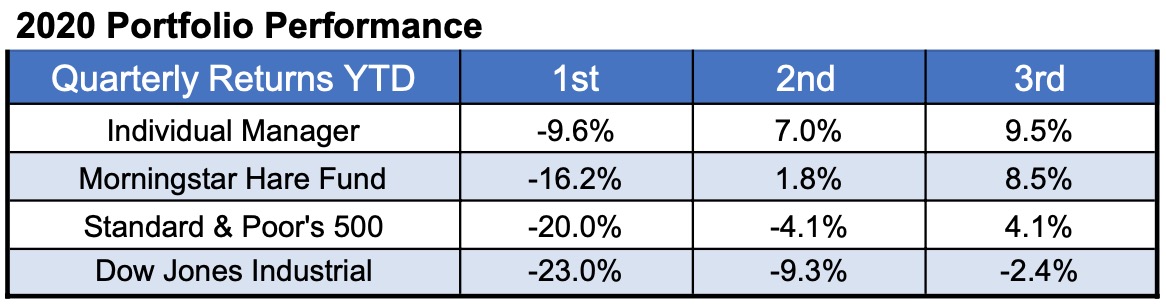

funds. But, if you bought that same e-mini on the first of this year and evaluated its year to

date performance on July 1st, you’d find it somewhat less impressive—down 4.1%. The Dow Jones

Industrial index has been even more anemic over the first half of the year, losing 9.3% of its

value in that time frame. Of course, this is due to the current pandemic, but it bears

mentioning that Morningstar’s Hare Fund had managed to wring out a 1.8% rise through active

trading of their stock portfolio by professionals. It seems that there are some advantages to an

actively managed fund, and this shouldn’t come as a surprise. It’s easy to garner returns on the

way up simply by being diversified, but on the way down it’s a different story.

I personally know of an independent trader that has weathered most of the recent storm and whose

account was up 7.0% this year—a feat accomplished through extensive use of options trading.

Surely there are countless other individuals and firms that have made even more money in 2020.

Why limit yourself to passive funds that lose money under bearish circumstances, or curtail your

gains by paying management fees? It seems that the only way to avoid those outcomes would be to

personally trade, or invest, your own account. So, the online brokers are right. Right?

Sort of.

Yes, if you want your portfolio to perform better in a weakening market and also save money on

management expenses, investing for yourself is the only way to go.

But also no, in that discount brokerage firms don’t mention that it is a losing proposition for

the vast, vast majority of people. The difficulty rating on the “do it yourself spectrum” is

high. It is a task which lies much closer to successful self-surgery than amateur gardening. Why

is that? The reason is simple. You will be competing against the aforementioned managers, firms

and traders who do this professionally, for a living. One can safely bet that the pros have

better and more up to date information to decide which stocks are undervalued, which companies

might be facing legal issues, and which industries are on the decline. If an amateur decides to

dip their toes into actively trading more esoteric instruments like derivatives or futures, they

will have to match wit and nerve with the best players in a worldwide arena. Did I mention that

their algorithms will be more precise, their software more robust, their hardware light years

faster, and their pockets endlessly deeper?

All of that might be surmountable, but the time commitment will not be. Much of the competition

will not only be putting in their weekly dues, but they will be checking markets after hours,

reading articles, and having casual conversations about financial topics—for fun. For some

managers and traders, it is not just a profession. It is a passion. It gets them up in the

morning. It is their life.

To compete with the pros you have to be a pro. Make no mistake, it is a competition. Unlike

creating and tending a backyard garden, there is no intrinsic reward for investing or trading at

a sub-par level. People are unlikely to look back on poor returns and find solace in knowing

that “they did it themselves.” At least I have yet to hear it. These are just scenarios that are

“slightly less good.” Any risk manager for an online brokerage has story after story of customer

accounts that they have had to liquidate or close after they went belly-up. You can call a

plumber after a failed experiment in amateur sink repair. I’m not sure who you call after losing

part or all of your retirement nest.

Sure, there are some people who will have an innate knack for the craft and there are others who

will catch a few breaks and get lucky. Most will struggle, stress, and fight to keep within

punching distance of professionally managed portfolios and passive index funds. If all of this

still sounds appetizing to you, then you might want to consider a career change and enter the

world of professional finance. But the next time the slick man from the TV commercial, or pop-up

ad starts trying to sell you on online trading, hit the mute button and remember what he’s

really saying, “You Too Can Save On Management Fees While Going Broke!”